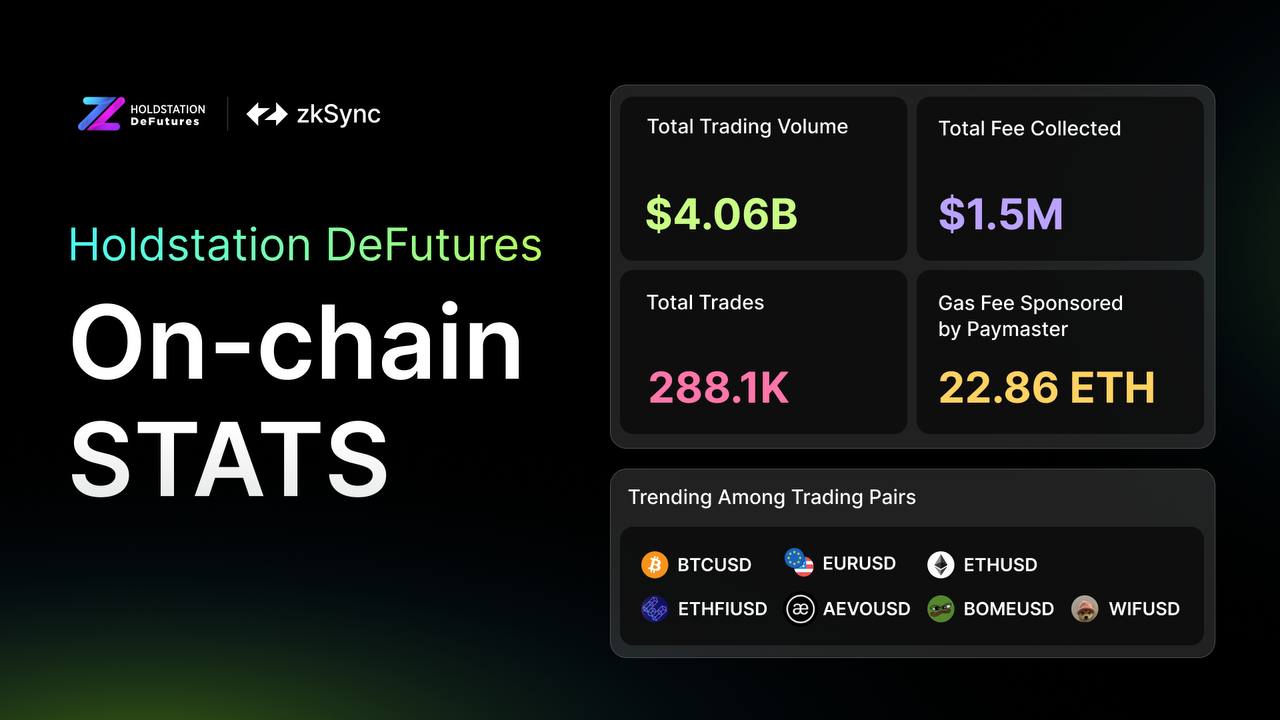

Holdstation DeFutures has carved a niche for itself in the ever-evolving landscape of cryptocurrency derivatives trading. But beyond the platform’s sleek interface and user-friendly features lies a robust engine churning out impressive results. This deep dive explores the key performance metrics and protocol insights that paint a clear picture of Holdstation DeFutures’ capabilities.

Holdstation DeFutures: A Glimpse Under the Hood

Before delving into the statistics, let’s establish a foundational understanding of what makes Holdstation DeFutures unique. This platform differentiates itself through several key features:

-

Leveraged Trading: Holdstation DeFutures empowers traders to amplify their potential profits (or losses) by utilizing leverage of up to 500x. This allows them to control a larger position in the market with a smaller amount of their own capital.

-

Advanced Order Types: Beyond basic market and limit orders, Holdstation DeFutures offers a variety of advanced order types, including stop-loss and take-profit orders. These tools enable traders to automate their strategies and manage risk more effectively.

-

Security and Transparency: Built on the zkSync 2.0 layer 2 scaling solution, Holdstation DeFutures leverages zk-proofs, a cryptographic technique that ensures transaction verification without revealing all their details. This enhances security and scalability compared to traditional blockchain-based platforms.

-

User-Friendly Interface: Despite its advanced features, Holdstation DeFutures prioritizes user experience. The platform boasts a clear and intuitive interface, making it accessible to both seasoned traders and newcomers to the crypto derivatives market.

Metrics that Matter: A Deep Dive into Performance

Now, let’s delve into the world of numbers and explore some of the key performance metrics that showcase Holdstation DeFutures’ capabilities:

-

Daily Trading Volume: This metric reflects the total amount of cryptocurrency derivatives traded on the platform within a 24-hour period. A consistently high daily trading volume indicates a healthy and active user base, fostering market liquidity for traders.

-

Open Interest: This metric represents the total value of outstanding derivative contracts that haven’t been settled yet. A rising open interest signifies growing user confidence and potential for future market volatility.

-

Liquidation Rate: This metric reveals the percentage of leveraged positions that get liquidated due to insufficient margin. A low liquidation rate indicates effective risk management practices by traders and the platform’s robust risk management systems.

-

Funding Rate: This metric reflects the fee paid by perpetual contract holders with a long position to those holding a short position. A positive funding rate incentivizes short positions, while a negative funding rate encourages long positions. Analyzing funding rates can help traders understand market sentiment and potential price movements.

Protocol Insights: Unveiling the Mechanisms Behind the Metrics

Understanding the key metrics is crucial, but to gain a holistic view, we need to explore the underlying mechanisms that influence them. Here are some protocol insights that contribute to Holdstation DeFutures’ impressive performance:

-

Margin Requirements: The minimum amount of capital required to maintain a leveraged position. Higher margin requirements reduce the risk of liquidations but also limit potential profits. Holdstation DeFutures employs a dynamic margin system that adjusts requirements based on market conditions.

-

Auto-Deleveraging: A mechanism that automatically closes out a portion of a leveraged position to maintain the minimum margin threshold. This helps prevent liquidations and protects traders from excessive losses.

-

Risk Management Tools: Holdstation DeFutures offers a suite of risk management tools, such as stop-loss orders and take-profit orders. These tools empower traders to automate their strategies and limit potential losses.

-

Order Book Depth: A deep order book reflects a high number of buy and sell orders at various price points. This depth ensures smooth order execution and reduces the risk of slippage, where the executed price deviates from the intended price.

Beyond the Numbers: The Human Element

While the statistics paint a compelling picture, it’s important to acknowledge the human element that drives Holdstation DeFutures’ success. The platform’s development team plays a vital role by continuously innovating and refining the protocol to enhance its performance, security, and user experience. Additionally, the active community of traders contributes to the platform’s liquidity and growth.

Read more:

Holdstation Fuels the Future: $215,000 Grant Propels AutoAir AI and zkSync’s AI Landscape

Holdstation Wallet A Secure Gateway to the Future of DeFi

Holdstation Exchange: A Decentralized Powerhouse for Crypto Trading

The Future Unfolds: A Look Ahead for Holdstation DeFutures

Holdstation DeFutures‘ impressive stats and protocol insights reveal a platform poised for continued growth. As the crypto derivatives market evolves, Holdstation DeFutures is well-positioned to maintain its competitive edge through continuous innovation in several key areas:

-

Expanding Asset Support: Integrating a wider range of cryptocurrencies and derivative products will cater to a broader user base and attract new market participants.

-

Advanced Trading Features: Introducing more sophisticated order types and technical analysis tools will empower experienced traders to develop and execute complex trading strategies.

-

Enhanced Security Measures: Continuous