Holdstation Tokenomics , a prominent player in the realm of Decentralized Finance (DeFi), particularly ZK-Sync leveraged futures trading, boasts its native token, $HOLD. This token serves a pivotal role within the Holdstation ecosystem, functioning as a utility token, a governance token, and a potential store of value. This in-depth exploration delves into the intricacies of Holdstation tokenomics, encompassing supply distribution, allocation specifics, utility functions, governance capabilities, and the potential future value proposition of the $HOLD token.

Holdstation Tokenomics Understanding the $HOLD Token Distribution

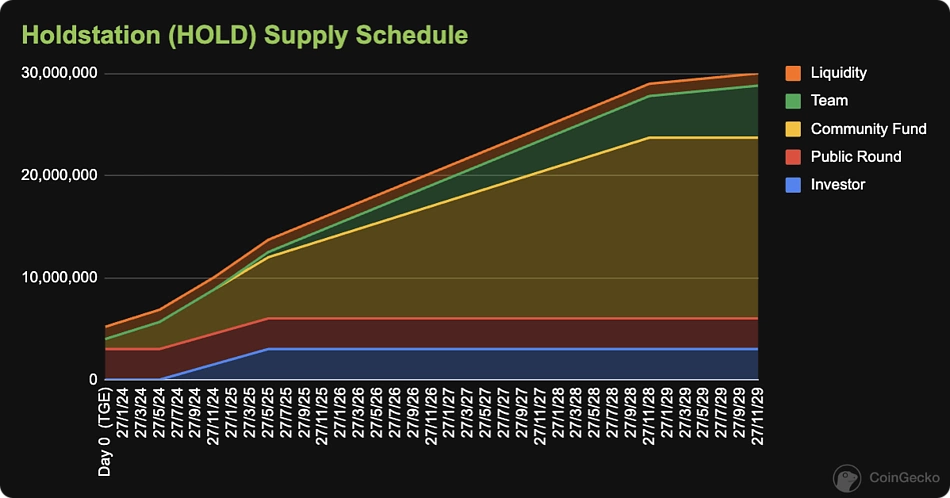

The $HOLD token distribution model plays a crucial role in ensuring the token’s long-term sustainability and potential value appreciation. Here’s a breakdown of the total supply and its allocation:

-

Total Supply: A predetermined maximum supply of 1,000,000,000 (One Billion) $HOLD tokens represents the highest number that will ever be minted. This capped supply helps prevent inflation and potentially contributes to the token’s long-term value proposition by creating scarcity.

-

Distribution Breakdown: The total supply is distributed across various segments, with each segment playing a specific role within the Holdstation ecosystem. While the exact allocation might vary depending on the specific details of the project, a typical breakdown could be as follows:

- Team & Advisors (15-20%): A portion of the tokens is allocated to the Holdstation team and advisors as compensation for their ongoing development and support of the platform. This allocation incentivizes the team’s long-term commitment to the project’s success and ensures they have a vested interest in the token’s value.

- Treasury (10-15%): A reserve of tokens is held by Holdstation for various purposes, such as future ecosystem development, strategic partnerships, marketing initiatives, and potential liquidity provisioning activities. This treasury allocation ensures resources are readily available to fuel the platform’s growth and foster long-term sustainability.

- Public Sale (40-50%): A significant portion of the tokens is offered through public sales, allowing the community to participate in the project’s growth and development. This widespread distribution fosters a sense of community ownership and potentially increases the token’s liquidity by creating a readily available market for buying and selling $HOLD tokens.

- Ecosystem Rewards (15-25%): A designated amount of tokens is reserved for rewarding users who actively participate in the Holdstation ecosystem. This can include rewards for providing liquidity on decentralized exchanges (DEXs), engaging in futures trading activity on Holdstation DeFutures, or contributing to the platform’s governance process through proposal creation and voting. This incentivizes user engagement and fosters a sustainable ecosystem by rewarding those who contribute to its growth and activity.

Additional Considerations:

- Lockup Periods: To ensure long-term commitment from token holders and potentially prevent excessive selling pressure in the initial stages, a portion of the allocated tokens (particularly those distributed to the team, advisors, and potentially public sale participants) might have lockup periods. These lockup periods restrict token movement for a predetermined timeframe, fostering stability and preventing immediate dumps that could negatively impact the token’s price.

- Vesting Schedules: The distribution of tokens to the team and advisors might be structured through vesting schedules. This spreads the token allocation over a specific period, aligning incentives with the platform’s long-term development goals. By vesting tokens over time, the team is incentivized to remain committed to the project’s success for the designated vesting period.

Holdstation Tokenomics Unveiling the Multifaceted Utility of $HOLD

Holdstation, a prominent player in the realm of ZK-Sync leveraged futures trading within Decentralized Finance (DeFi), boasts its native token, $HOLD. While $HOLD plays a crucial role in facilitating futures trading activities on the Holdstation DeFutures platform, its utility extends far beyond mere order placement and execution. This exploration delves into the multifaceted functionalities of $HOLD, showcasing its ability to incentivize user participation, enhance platform engagement, and potentially contribute to the token’s long-term value proposition.

Reduced Trading Fees: Fueling Platform Adoption

One of the most prominent utility functions of $HOLD lies in its potential to reduce trading fees for users who hold the token. This incentivizes the use of $HOLD within the Holdstation ecosystem and fosters platform adoption. Here’s a closer look at how fee reductions with $HOLD can benefit both users and the platform:

- Cost Savings for Users: By holding $HOLD tokens, users can potentially enjoy significant reductions in trading fees associated with opening, maintaining, and closing leveraged futures positions on Holdstation DeFutures. This translates to increased profitability for users, making the platform more competitive compared to alternatives with higher trading fees. Reduced fees can attract new users to the platform and incentivize existing users to trade more frequently, potentially boosting overall trading activity.

- Increased Demand for $HOLD: The prospect of lower trading fees creates an incentive for users to acquire and hold $HOLD tokens. This increased demand can contribute to a rise in the token’s price, potentially benefiting long-term token holders. Additionally, a larger user base holding $HOLD fosters a stronger and more stable community around the token.

Tiered Fee Structure: The fee reduction mechanism might be implemented through a tiered system. Users with higher $HOLD holdings would enjoy progressively larger fee discounts, further incentivizing users to accumulate and hold $HOLD tokens for maximum benefits.

Read more:

Holdstation Exchange A Decentralized Powerhouse for Crypto Trading

Holdstation Wallet A Secure Gateway to the Future of DeFi

Holdstation: Your Gateway to the Future of DeFi

Priority Access: Rewarding $HOLD Loyalty

Holdstation can leverage $HOLD to reward user loyalty and incentivize long-term token ownership by offering priority access to features and functionalities within the platform. Here are some potential ways priority access with $HOLD could be implemented:

- Early Access to New Features: $HOLD holders might be granted exclusive early access to new features or functionalities rolled out on the Holdstation platform. This could encompass access to innovative trading tools, advanced order types, or beta testing opportunities for upcoming platform enhancements. Early access allows users to experiment with new features and potentially gain a competitive edge in the market.

- Increased Participation Limits: Certain platform activities, such as margin borrowing or position sizing, might have higher limits for users holding $HOLD tokens. This incentivizes users to accumulate $HOLD to unlock greater potential within the Holdstation ecosystem and potentially increase their trading opportunities.

Community Recognition: Holding $HOLD could also translate to benefits beyond mere access. Users with significant $HOLD holdings might be featured on community leaderboards or granted exclusive access to community forums or communication channels, fostering a sense of recognition and belonging within the Holdstation ecosystem.

Staking Opportunities: Aligning User Incentives with Platform Security

Staking mechanisms offer a win-win scenario for both users and the platform. By staking their $HOLD tokens, users can potentially earn rewards while contributing to the overall security and liquidity of the Holdstation ecosystem:

- Earning Rewards: Users who stake their $HOLD tokens can potentially earn rewards in the form of additional $HOLD tokens or other platform-specific incentives. This incentivizes long-term $HOLD ownership and encourages users to contribute to the platform’s stability.

- Enhanced Platform Security: Staking mechanisms can lock up a portion of the circulating $HOLD supply, potentially contributing to a more stable token price. Additionally, staking rewards can be distributed from transaction fees collected on the platform, further aligning user incentives with the platform’s long-term health.

- Increased Liquidity: Staking mechanisms can create a readily available pool of $HOLD tokens that can be used for various purposes within the ecosystem, such as facilitating margin lending or market making activities. This increased liquidity can potentially contribute to tighter spreads and smoother trading experiences for all users.

Flexible Staking Options: The Holdstation platform might offer various staking options with different lockup periods and corresponding reward structures. This caters to diverse user preferences, allowing users to choose staking options that best align with their investment goals and risk tolerance.

The Future of $HOLD Utility: A Multifaceted Ecosystem

The exploration of $HOLD’s utility extends beyond the functionalities mentioned above. As the Holdstation ecosystem matures, we can expect to see the introduction of even more innovative ways to leverage $HOLD:

- Governance Participation: $HOLD can serve as a governance token, empowering holders to participate in shaping the future direction of the Holdstation platform through proposal creation and voting. This fosters a sense of community ownership and incentivizes long-term $HOLD